When Posting an Adjusting Entry to the General Ledger Write

The second entry closes expense accounts to the Income Summary account. It is fully integrated into the General Ledger.

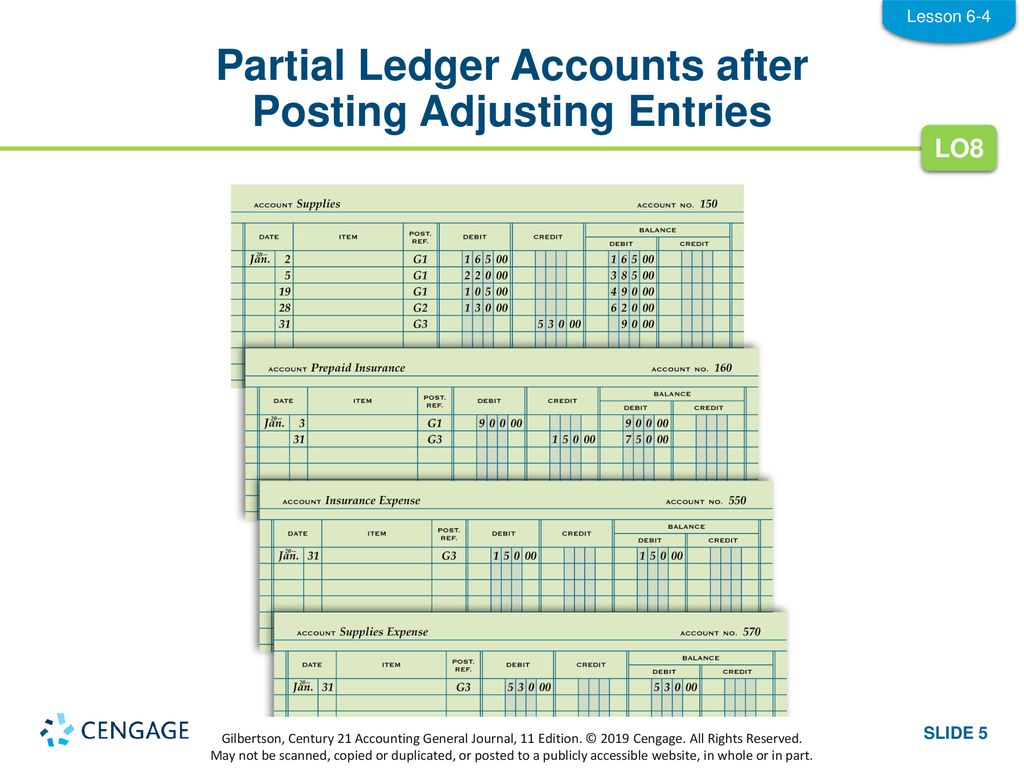

Lesson 6 4 Journalizing And Posting Adjusting Entries Ppt Download

Four entries occur during the closing process.

. Unearned revenue would be debited for 700. For example income earned but not recorded in the books. Debit to Salaries Payable and credit to Salaries Expense.

Check to be sure that a debit entry has been recorded for each credit entry. The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total. Adjusting entries are made for accrual of income and expenses depreciation allowances deferrals and.

The fiscal year variant of the GL ledgers are supported. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Drill down from General Ledger transaction history to Accounts Receivable transactions and then to originating Order Entry transactions.

The eighth step in the accounting cycle is preparing closing entries which includes journalizing and posting the entries to the ledger. 1000 of cash was received in. Debit the appropriate expense.

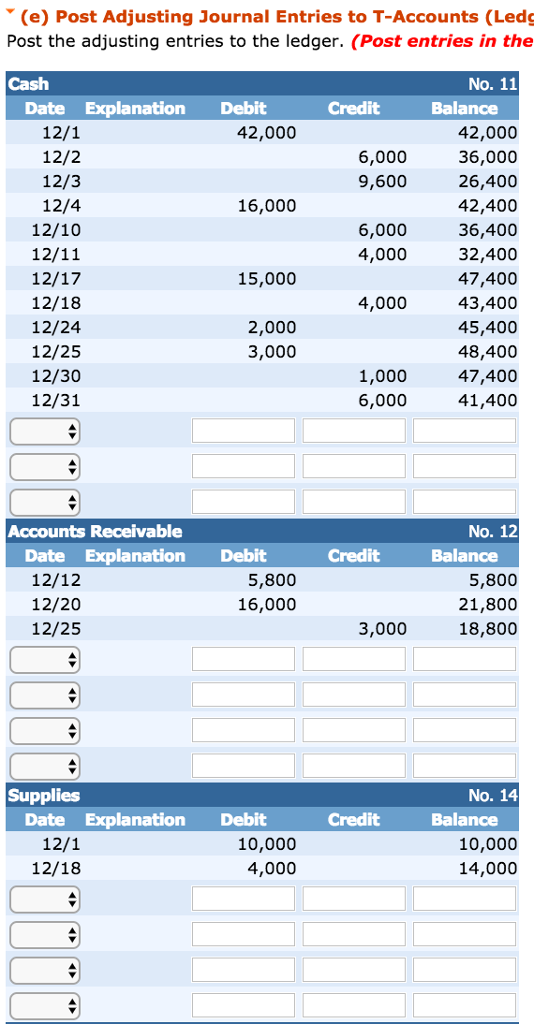

Which of the following is the correct adjusting entry. The process of recording transactions in a journal is called journalizing while the process of transferring the entries from the journal to the ledger is known as posting. Compare each entry with the source document for the entry.

The Accrual Engine postings are stored only as line items of the universal journal entry in table ACDOCA. Journal entries are either recorded in subsidiary ledgers if youre keeping your books manually or theyre recorded directly into the general ledger GL if you use accounting software. Standard FI reversal eg.

Collect the source documents like receipts or invoices that need to be logged. Posting means to transfer journal information to a ledger. Posting to the general ledger is step 2 in what is known as the accounting cycle.

At the end of the accounting period the accountant must prepare the adjusting entries to update the accounts that are summarized in the financial statements. The adjusting entry should be made as follows. Using transaction FB08 or F80 is supported.

Finding Errors by Proving Cash Cash is proved when the balance on hand at the end of the month is the same as the checkbook balance at the end of the. When posting any kind of journal entry to a general ledger it is important to have an organized system for recording to avoid any account discrepancies and misreporting. Be sure that the debit entry equals the credit entry.

Import transactions from other applications. This separate posting type is necessary if the release of accruals from previous fiscal years needs to be clearly recognizable in reporting. They have just completed the posting of general entries and recording all of their transactions.

Press the button to proceed. Make the appropriate adjusting entry. Late Manual Release Posting RL A late release posting reduces existing accruals that were posted in an earlier accrual closing period that is typically in a previous fiscal year.

After you reconcile a checkbook the amount in the Last Reconciled Balance field is the same as the bank statements ending balance in the Reconcile Bank. Your browser does not support JavaScript or it is turned off. Write down the name and industry type of the company you are discussing.

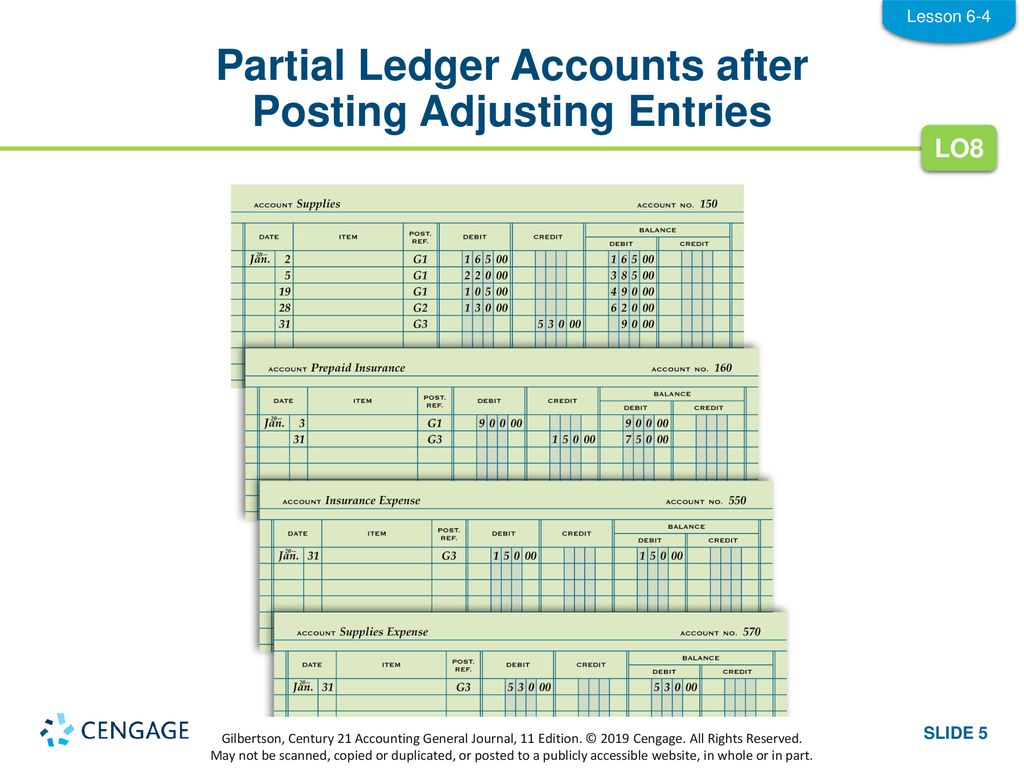

The transactions in a journal are recorded in a chronological order making it easy to identify the transactions are associated with a given business day week or another billing period. You accrue expenses by recording an adjusting entry to the general ledger. You are required to prepare a trial balance.

The adjusting entry that Able should make to accrue these unpaid salaries on December 31 Year 1 is. Below are balances reported at the end of the quarter. All currencies of General Ledger are supported.

Get 247 customer support help when you place a homework help service order with us. Adjusting entries occur at the end of the accounting period and affect one balance sheet account an accrued liability and one income statement account an expense. If you change the last reconciled balance after saving the checkbook you must enter an adjustment in General Ledger for the Cash account because an adjusting entry wont be automatically entered.

The accounting cycle can be broken down into a few simplified steps. Multiple Choice debit to Salaries Expense and credit to Cash. Brief description of the nature of the transaction effected.

No entry is required until the employee is paid next period. Debit to Salaries Expense and credit to Salaries Payable. In this lesson you will prepare for the end of the fiscal period by adjusting your asset account balances to accurately reflect the assets remaining at the end of the year.

Service revenue would be credited for 700. Schedule any number of recurring charge invoices for fast invoicing of monthly charges and update recurring charges automatically by amount or percentage. On its own the ledger wouldnt be very helpful but used as a part of the cycle it is an invaluable tool.

Suresh Oberoi is in the stage of preparing financial statements for the quarter ended March 2019. A general ledger helps to achieve this goal by compiling journal entries and allowing accounting calculations. Posting from general journal to general ledger or simply posting is a process in which entries from general journal are periodically transferred to ledger accounts also known as T-accountsIt is the second step of accounting cycle because business transactions are first recorded in the journal and then they are posted to respective ledger accounts in the general.

The first entry closes revenue accounts to the Income Summary account. You will also find out how to journalize and post adjusting and closing entries to.

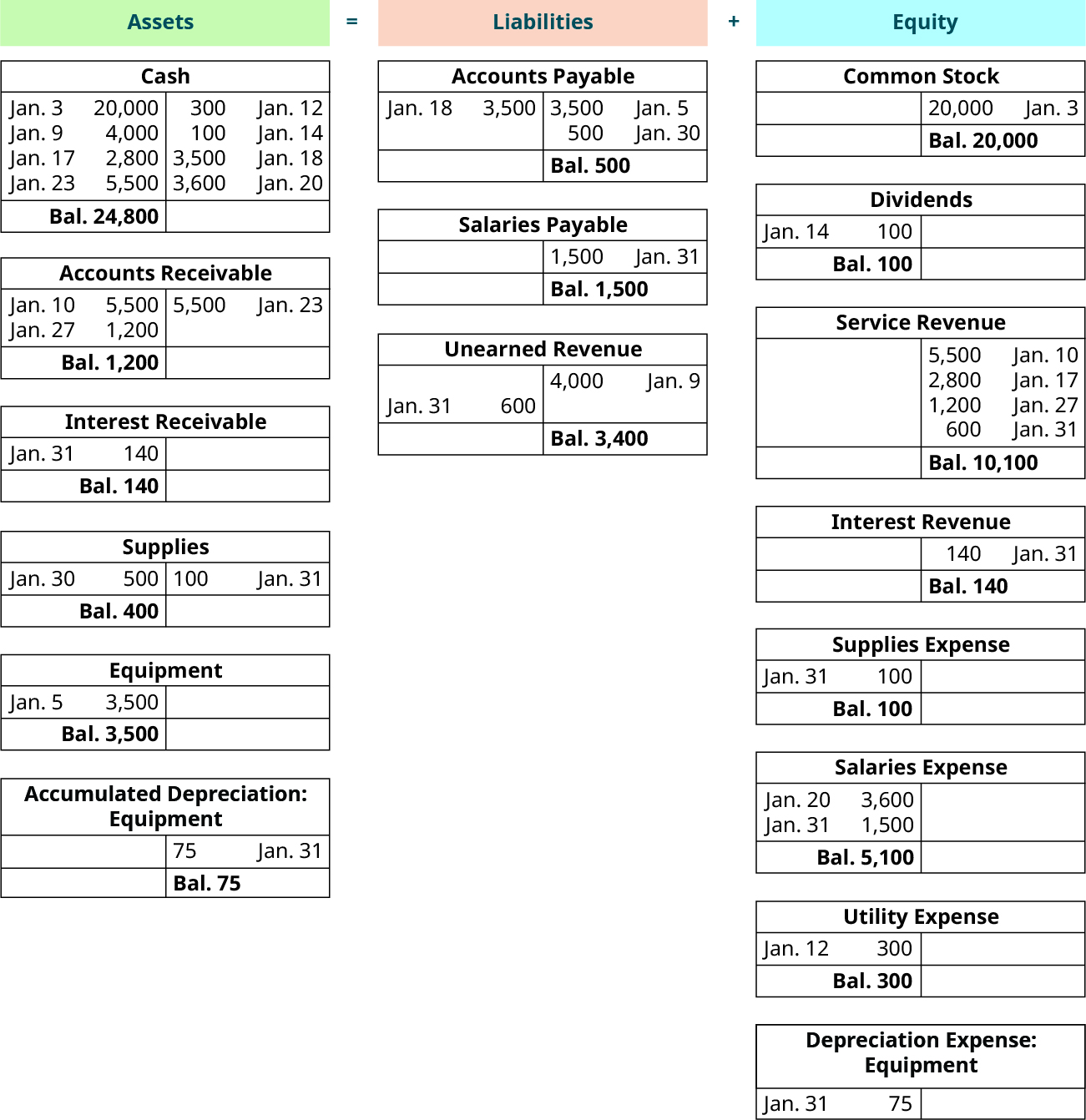

Solved E Post Adjusting Journal Entries To T Accounts Chegg Com

Journalizing Posting Adjusting Entries From Worksheet Professor Victoria Chiu Youtube

Accounting Cycle Example 2 Posting Adjusting Entries To The General Ledger Youtube

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment